Micro, small and medium-sized enterprises (MSMEs) are the building blocks of every nation’s economy, accounting for up to 90% of businesses and 70% of employment worldwide.1 Unsurprisingly, SME development has become a key priority for many governments, as evidenced by UNDP’s extensive country-level work in that field, around the world.

Yet, globally, MSMEs still face structural gaps in accessing affordable finance to build their businesses and capitalize on new opportunities. The World Bank estimates that MSMEs are facing a financing gap of US$5.2trillion every year, despite receiving increased attention. This is especially critical at a time when billions rely on micro-businesses for their livelihoods and entire nations’ economies are dependent on their MSME backbones. With the accelerated growth of the digital economy, new financing pathways are opening up, but financial and digital capabilities are a pre-requisite for accessing these and traditional financing options will therefore remain central to MSME development and for supporting the transformation needed to reap the digital dividend. The financing gap is therefore a global priority that should be collectively addressed.

Collateral-based lending has restricted financing for many MSMEs in the ASEAN region and beyond for generations, with persistent issues such as lack of auditable performance track record, unverified data from MSMEs, financial illiteracy, and fragmented regional and global approaches continuing to reinforce existing financial exclusion. While innovative approaches using alternative form of data, such as utility bills paid on time, supply contracts fulfilled regularly or verified trade volumes in online markets are opening new avenues for building trust between lenders and MSMEs, unless the issue is tackled more systematically and at a global level, we may fall short of leveraging both data and digital opportunities for the benefit of our MSMEs.

To address this daunting challenge, the United Nations Development Programme (UNDP) and the Monetary Authority of Singapore (MAS) are working with leading Central Banks across Asia, Africa and Europe4, bank and non-bank financial institutions, multilateral agencies and other stakeholders towards building global consensus around a data-driven, digitally enabled, characterization of MSME creditworthiness and business trust, in the form of an individual data profile called Universal Trusted Credential (UTC), with a view to facilitate wider, deeper and faster financial inclusion of businesses, in particular MSMEs.

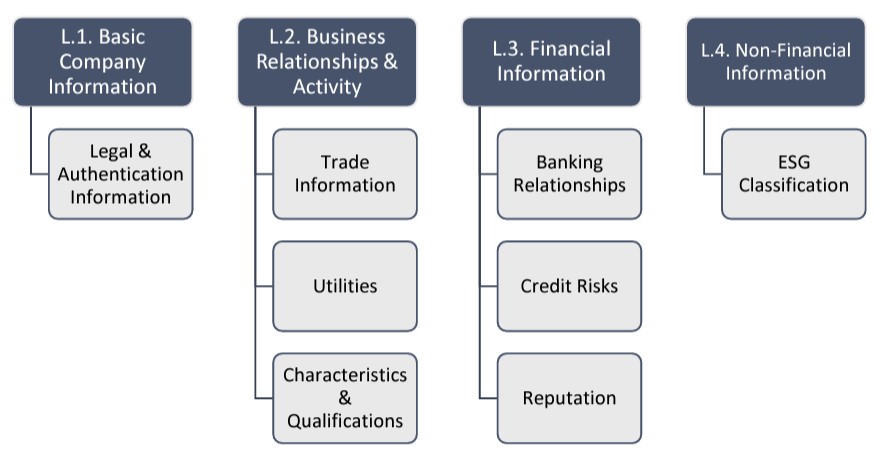

The UTC is intended to catalyse a fundamental change in how financial services for businesses, in particular, MSMEs, are provided – by consolidating and verifying a wider set of alternative data that characterize the business from an intent to pay and an ability to pay perspectives. The UTC data broadly covers information on what the entity is, its business activities and characteristics, its trade- and non-trade behaviour and standing of the entity and on the financial actions and history of the entity.

Source: UNDP