The report “Less is More“, authored by an expert group in February 2025 presents a critical analysis of the current regulatory framework governing the European financial services sector. It highlights the inefficiencies and complexities within the existing rule-making process and proposes strategies for simplifying and enhancing financial regulations. The report was published with the support of various European associations and institutions and features contributions from legal and financial experts.

Foreword and Central Message

In the foreword, Jacques de Larosière, a well-respected figure in the financial sector, underscores the urgency of regulatory reform. He points out that while European financial integration has seen significant progress, the current regulatory framework is often excessive, complex, and inconsistent. This, in turn, creates unnecessary burdens on financial institutions and reduces the sector’s overall efficiency.

One of the key concerns raised in the report is the overproduction of regulatory texts, which results in a cumbersome legal framework that is difficult to navigate. The report argues that such complexity undermines the competitiveness of European financial institutions, as they must allocate excessive resources to compliance rather than innovation and economic growth. Simplification and consolidation of regulatory texts are, therefore, presented as a priority.

Key Proposals for Reform

- Streamlining Regulations. The report advocates for a reduction in the number of regulatory texts and a move toward a more principles-based regulatory approach. This would involve eliminating redundant rules, ensuring greater coherence among existing regulations, and focu1sing on core financial principles rather than excessively detailed legal requirements. The report suggests that regulatory clarity and predictability are crucial for fostering a stable and competitive financial market.

- Strengthening Decision-Making Processes. Another major point of the report is the need to improve the decision-making process within European financial regulatory bodies. Currently, decision-making is often fragmented, with too many stakeholders involved in regulatory discussions. The report recommends that senior-level regulators with real decision-making authority should be more actively engaged in regulatory discussions. This would help streamline the process, reduce unnecessary bureaucratic delays, and allow for more effective financial supervision.

- Reforming European Supervisory Authorities (ESAs). The report suggests that the leadership of the European Supervisory Authorities (ESAs) should come primarily from regulatory authorities rather than supervisory bodies. This shift would help strike a better balance between regulatory oversight and practical financial sector needs. The proposed reform aims to improve coordination among European financial regulators, reduce conflicts of interest, and enhance overall regulatory efficiency.

- Ensuring Regulatory Proportionality. Another key aspect of the report is the emphasis on proportionality in regulatory enforcement. The report argues that a one-size-fits-all approach is detrimental to the financial sector because it imposes the same compliance requirements on small and large institutions alike. Instead, a more flexible approach that takes into account the size, risk profile, and market impact of financial institutions is recommended. This would help reduce unnecessary administrative burdens on smaller firms while maintaining robust oversight of systemically important institutions.

- Balancing Stability and Competitiveness. The report stresses that while financial stability is a critical goal, it should not come at the expense of economic growth and competitiveness. A regulatory framework that is too rigid can stifle innovation and limit the ability of financial institutions to compete on a global scale. The report calls for a balanced approach that ensures financial stability while allowing sufficient flexibility for market-driven growth and development.

- Implications and Challenges. Implementing the proposed reforms would require a fundamental shift in regulatory culture and mindset. The report acknowledges that resistance to change is likely, particularly from institutions that benefit from the current regulatory framework. However, it argues that without significant reform, European financial institutions risk falling behind their global competitors.

- One challenge in implementing these reforms is the need for greater cooperation between national and European regulatory authorities. The report highlights that divergent national interests often lead to inconsistent application of financial regulations across member states, which further complicates the regulatory landscape. Achieving greater harmonization while respecting national specificities will be a key challenge for policymakers.

- Another potential challenge is ensuring that regulatory simplification does not lead to regulatory gaps or weaken financial stability. The report acknowledges this risk and emphasizes that regulatory reform should focus on improving efficiency rather than deregulation. The goal is not to reduce oversight but to make it more effective by eliminating redundancies and focusing on critical regulatory objectives.

Conclusion

The “Less is More” report presents a strong case for simplifying and improving financial regulations in Europe. By addressing regulatory complexity, improving decision-making processes, reforming the ESAs, and ensuring proportionality in regulation, the report provides a comprehensive roadmap for regulatory reform. While challenges exist in implementing these recommendations, the potential benefits in terms of financial stability, economic growth, and global competitiveness make the case for reform compelling. Policymakers and regulatory authorities should carefully consider these proposals to ensure a more efficient, balanced, and effective regulatory framework for Europe’s financial sector.

Summary by DigitalTrade4.EU

From Words to Action: Recommendations to the European Commission

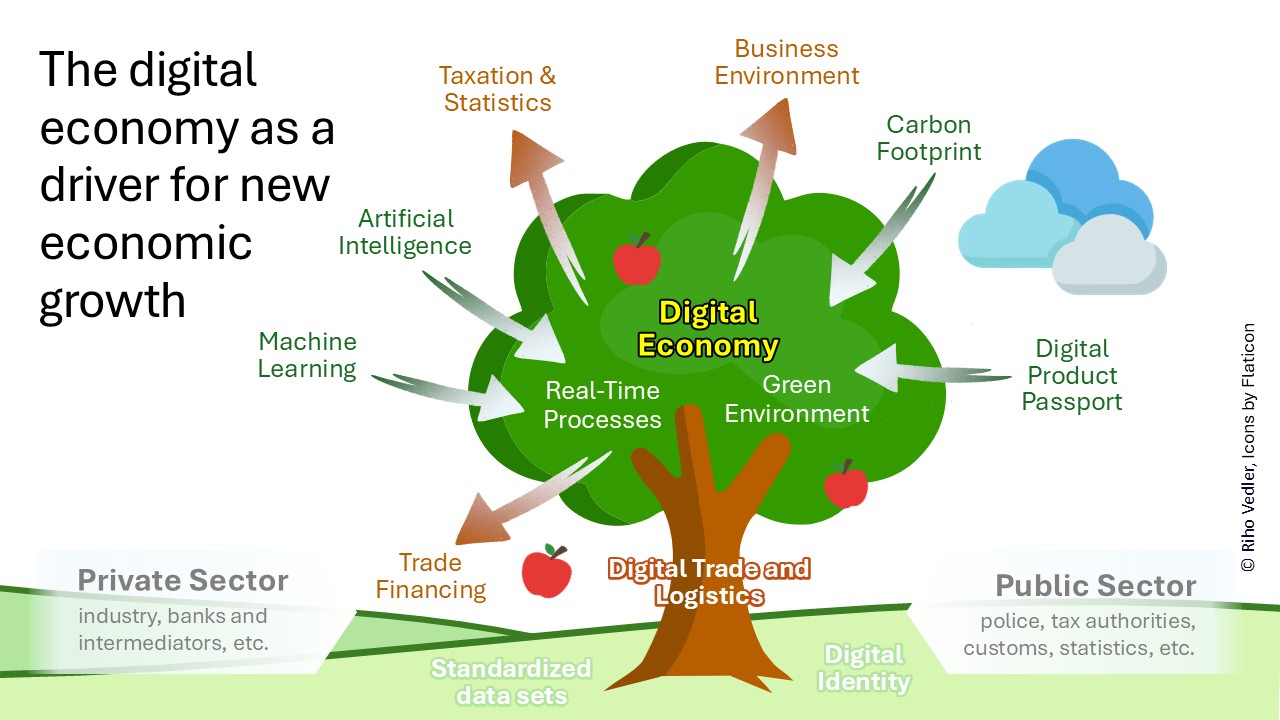

The European Commission can take strategic steps to enhance trade digitalization while integrating Environmental, Social, and Governance (ESG) objectives. Drawing insights from Philippe Henry’s analysis of trade digitalization efforts in France (Paris Europlace report “Dematerialization of Trade Finance and International Trade: France Must Accelerate to Stay in the Global Race“) and aligning them with the “Less Is More” report’s expectations, the following recommendations are proposed by DigitalTrade4.EU:

1. Strengthening Digital Trade Finance Instruments for ESG Goals

- Digital trade finance should not only enhance efficiency but also serve as a tool for sustainability.

- The implementation of electronic transferable records on base UNCITRAL Model Law on Electronic Transferable Records (MLETR) can reduce paper-based transactions, thereby lowering the environmental footprint.

- France’s legal adaptation in 2024, recognizing dematerialized commercial instruments, serves as a model for EU-wide standardization.

- ESG-focused trade finance tools should incentivize green investments, ensuring they function as enablers rather than compliance-driven barriers.

2. Ensuring Regulatory Consistency Across EU Digital Initiatives

- The EU eFTI Regulation (Electronic Freight Transport Information), requiring Member States to digitalize transport documentation by 2027, should be aligned with trade finance digitalization (MLETR) to ensure seamless interoperability.

- A coordinated regulatory framework should integrate eIDAS2, eFTI, PSD3 & PSR and MiCA regulations, ensuring that digital trade finance aligns with secure and sustainable European data policies.

3. Reducing Fragmentation and Establishing Interministerial Coordination

- The fragmentation of digital trade initiatives across EU Member States slows progress. The creation of an EU Trade Digitalization Council could centralize efforts, ensuring that digital finance, customs modernization, and sustainability policies align.

4. Leveraging Digitalization to Close the Trade Finance Gap

- The lack of digitalization disproportionately affects Micro, Small and Medium Enterprices (MSMEs), limiting their access to trade finance.

- Enabling irrevocable digital trade commitments (e.g., documentary credits, digital promissory notes) can enhance access to finance while ensuring compliance with ESG principles.

- The EU should explore AI-driven risk assessment tools to facilitate financing for sustainable trade.

Conclusion: A Strategic Opportunity for the European Commission

By integrating digital trade finance with ESG priorities, the EU can enhance global competitiveness while achieving sustainability goals. The Commission should act proactively, ensuring that trade digitalization is an enabler of economic and environmental resilience.