Recommendations of the European Banking Federation for the EU 2024-2029 term. The concluding legislature has been marked by a series of significant crises at both the international and European levels. Firstly, the global COVID-19 pandemic, then a war on the European continent resulting from the invasion of Ukraine. This conflict triggered an energy crisis, driving a rapid increase in inflation and a sharp rise in the cost of living for citizens.

Additionally, the escalating climate disruptions have been increasingly impacting the lives of citizens and businesses. And at the same time, a sweeping digitalisation of all aspects of human activities has been giving rise to new opportunities for progress and interaction, but also to broad risks on the social, democratic and critical services levels.

In this highly challenging context, European banks have not only demonstrated remarkable resilience but have also played a crucial role in upholding stability. They have provided tangible solutions and closely collaborated with policymakers to mitigate the impact of these crises on citizens and businesses.

These various crises have also exposed the vulnerability of value chains and the reliance of numerous sectors in the European economy on the rest of the world. More generally, they have accelerated Europe’s loss of competitiveness compared to other parts of the world, notably the US and Asia. This competitiveness, which fosters growth, is indispensable for the well- being of Europe and its citizens. It is essential for servicing the debt of states and companies, for financing the green transition, for investing in greater European innovation and security, and ultimately for supporting an aging population.

The upcoming years will remain challenging. Policymakers, businesses and households will continue to grapple with the consequences of the conflict in Ukraine, geopolitical tensions, inflation, soaring energy costs, disrupted supply chains, and a shortage of skilled labour. In addition, the rapidly expanding uptake of technology and advancements, such as generative Al and quantum computing, will continue reshaping nearly every industry and will impact society in ways that are only beginning to be understood.

However, the biggest challenge is climate change. Achieving the 2030 EU climate targets alone necessitates investments amounting to one trillion euros annually. Achieving net-zero emissions within the next three decades demands channelling trillions of investments to activities that support the transition to net-zero including those that would otherwise be allocated to carbon-intensive technologies.

All the current and future challenges and vulnerabilities – whatever their form or shape have one thing in common: they require additional financing and investment to support sustained and sustainable growth. This is why, now more than ever, also given the high level of debt among states and local authorities, Europe needs a banking and financial sector that is both resilient and profitable. The sector is crucial for funding the substantial investments needed to address the challenges, both immediate and long-term.

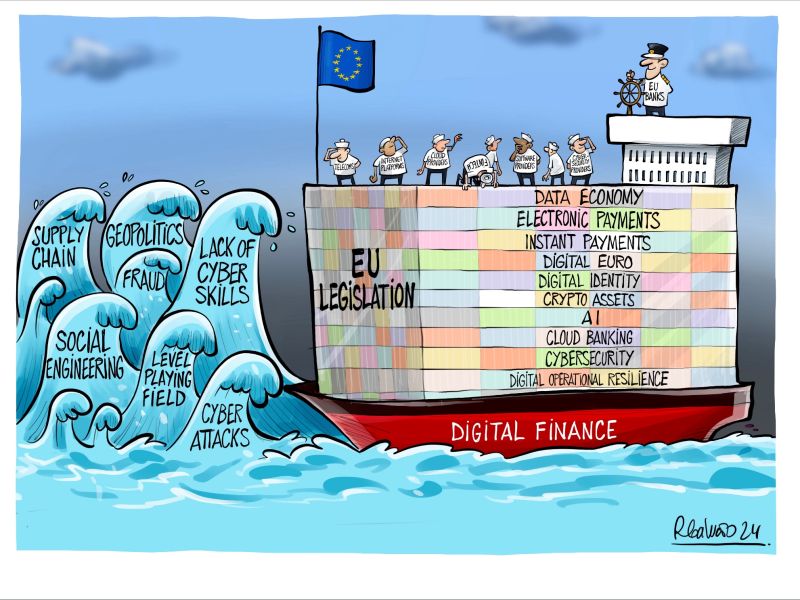

The banks are fully prepared to assume their responsibilities and play their role within society. However, they do require a regulatory framework that enables the industry to remain competitive in an ever-evolving global market and ensures fair competition for all entities providing financial services.

Source: European Banking Federation (EBF)