Latest news

-

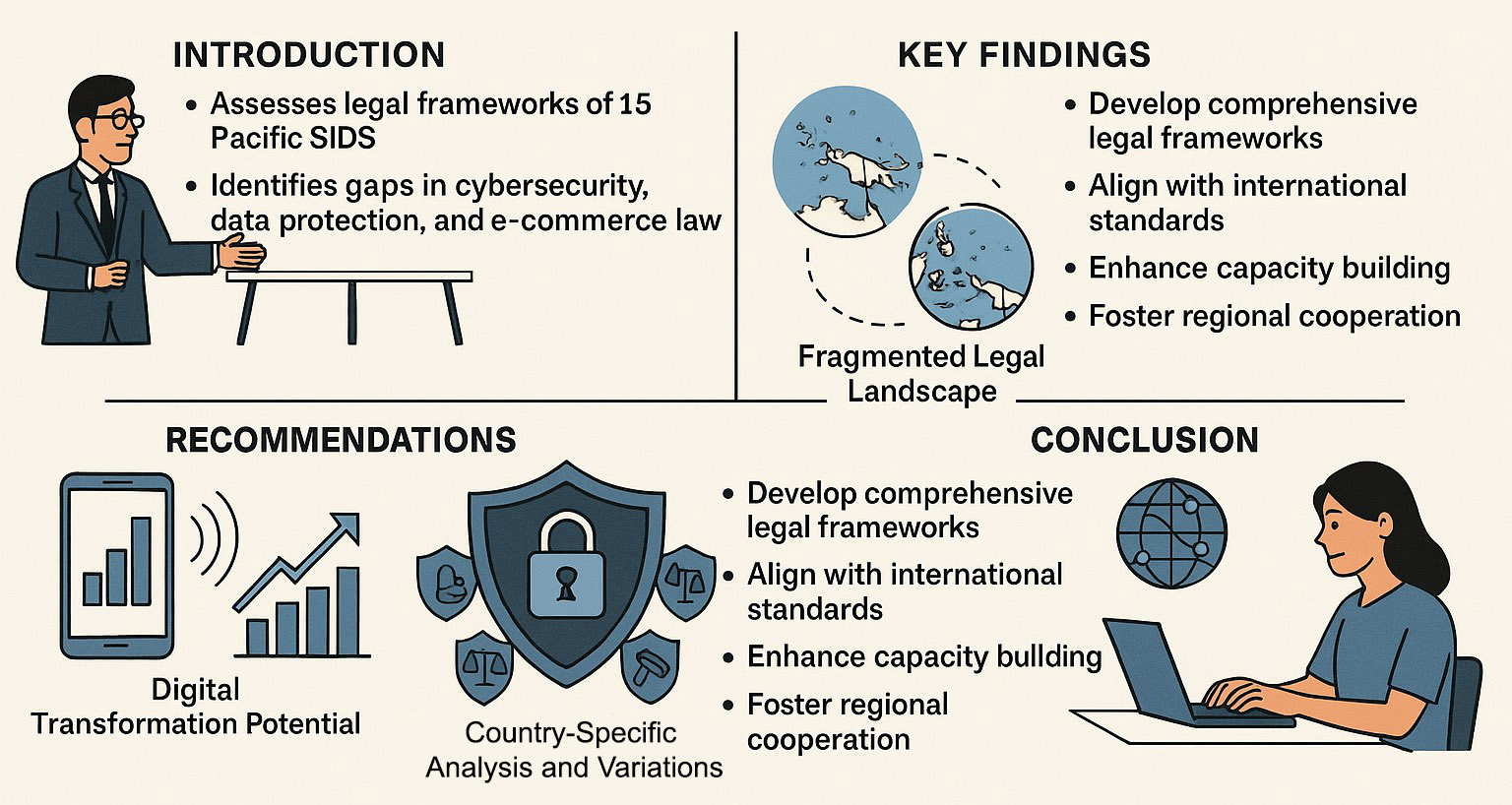

Gap Analysis of Cyberlaws in Pacific Small Island Developing States

The Gap Analysis of Cyberlaws in Pacific Small Island Developing States report by the United Nations Conference on Trade and Development (UNCTAD) is an extensive document that assesses the state… Read more

-

Trade Finance in Central America and Mexico: Challenges and Opportunities

On base report “Trade Finance in Central America and Mexico” trade finance plays a crucial role in facilitating the smooth flow of goods and services across borders. In Central America… Read more

-

Leading the Development of International Rules for the Digital Economy

On April 27, the National Internet Information Office released the “China Network Rule of Law Development Report (2024)”, the first comprehensive annual report on network rule of law at the… Read more

-

Revolutionizing Global Trade with Electronic Bills of Lading

International Trade Centre created document “Expediting Trade Through Electronic Bills of Lading” focuses on the growing use of electronic bills of lading (eBLs) in global trade, an innovative digital solution… Read more

-

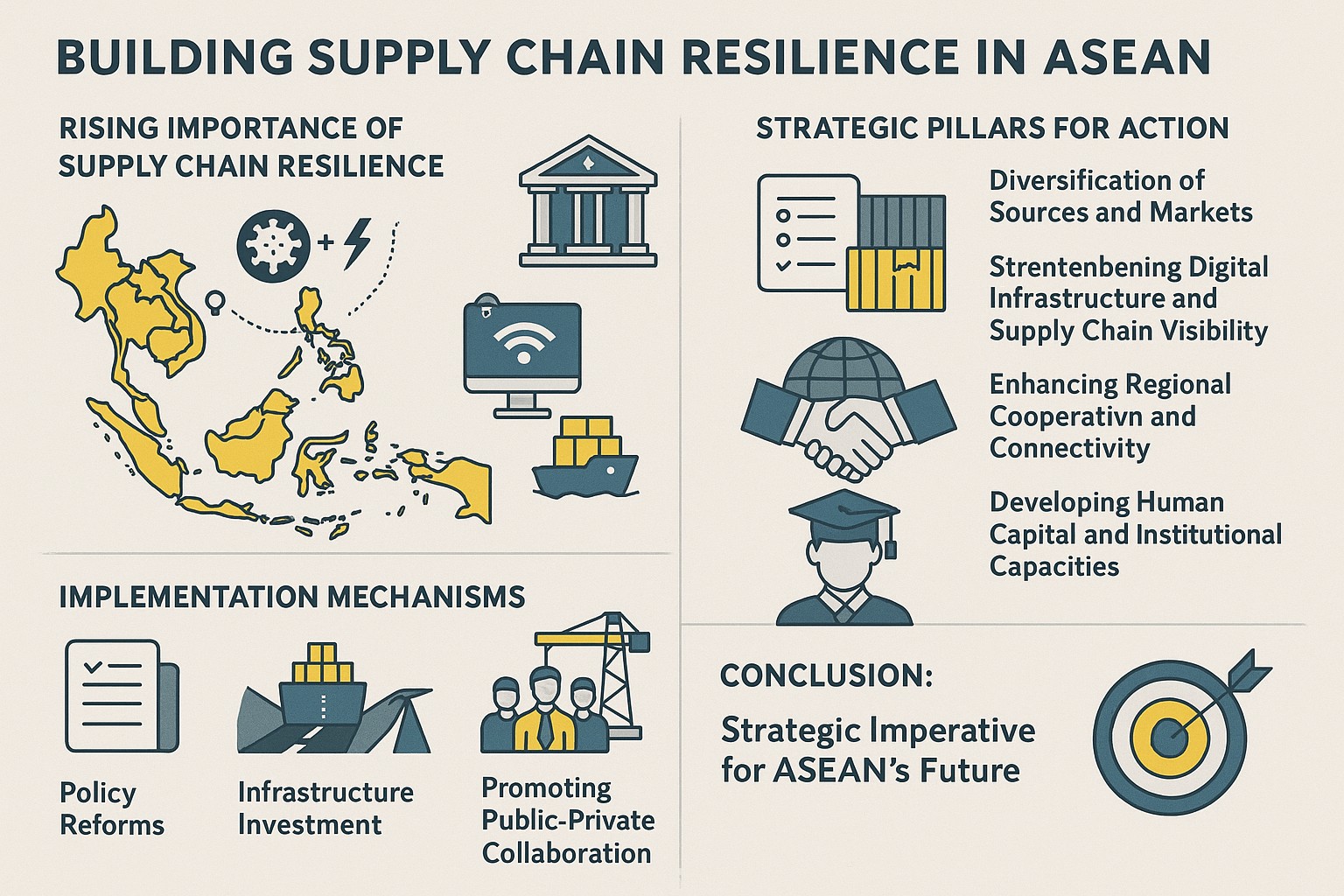

Building Supply Chain Resilience in ASEAN: Extended Analysis of ADB’s Strategic Roadmap

The Asian Development Bank (ADB), in its report Building Supply Chain Resilience in ASEAN, presents a detailed strategy for how ASEAN economies can fortify their supply chains in an increasingly… Read more

-

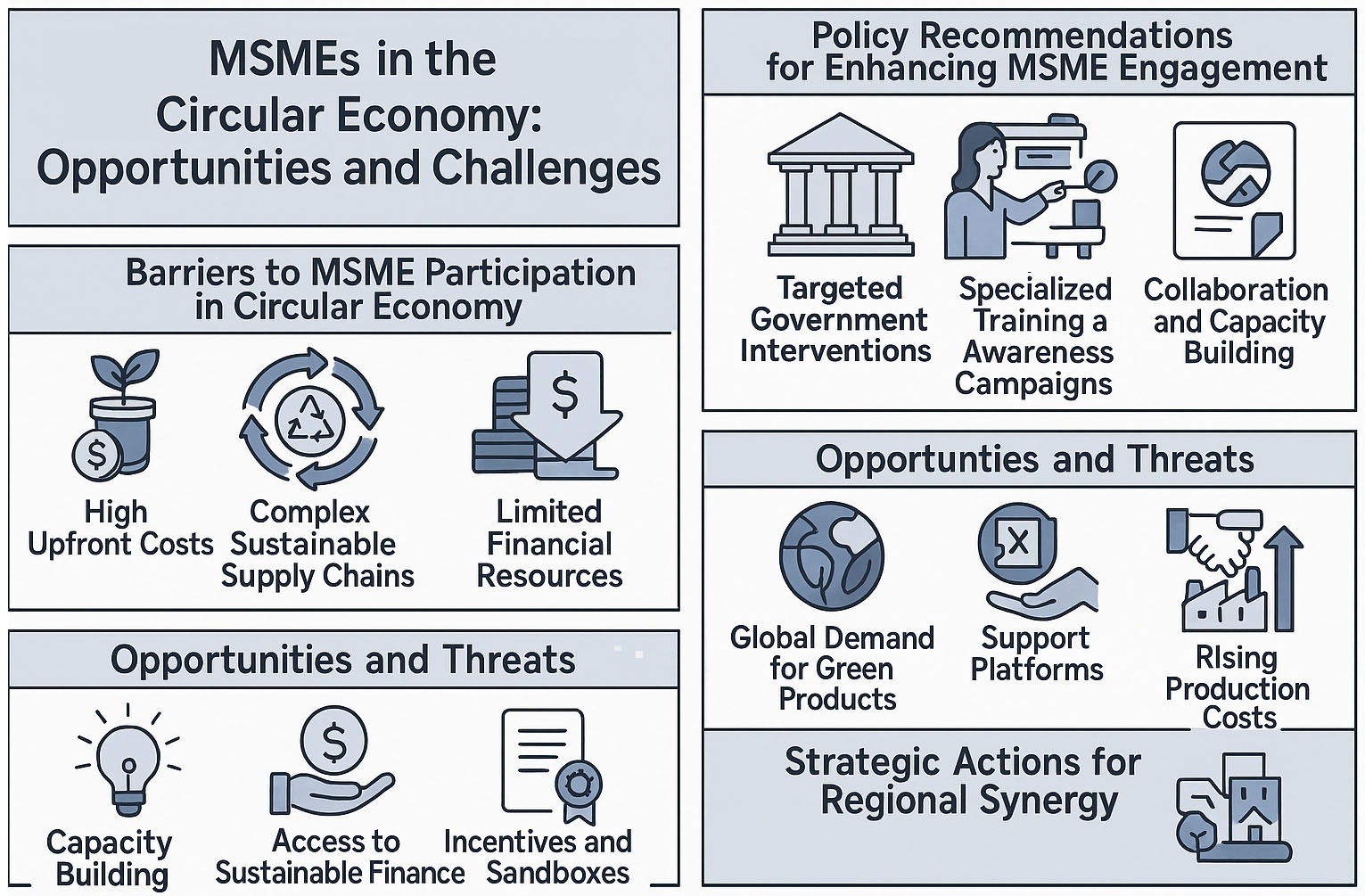

Empowering ASEAN MSMEs in the Circular Economy: Opportunities and Challenges

The recent study titled “Study on MSME Participation in the Circular Economy”, published by the ASEAN Secretariat with support from GIZ, provides an in-depth analysis of the role of Micro,… Read more

Interesting videos

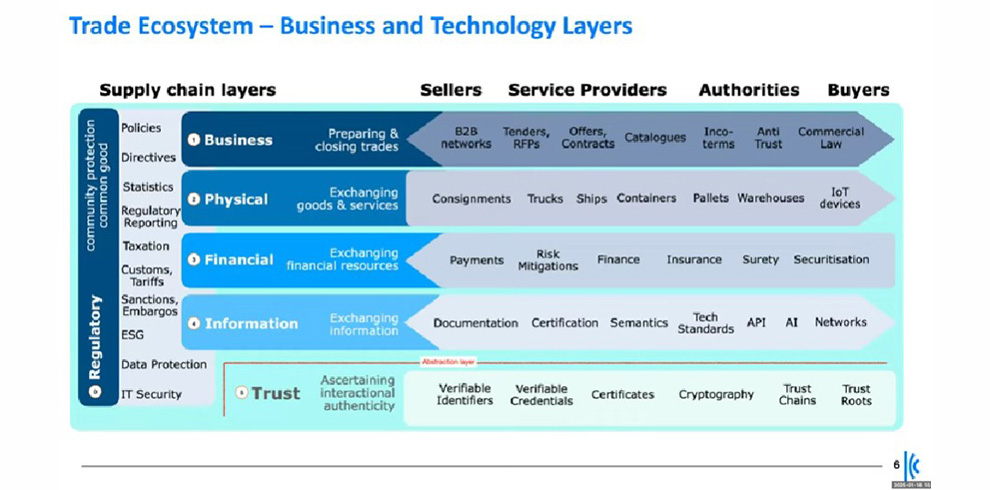

Digitalising Trade Finance for Europe’s Future

Shared podcast discusses a European initiative to accelerate the digitalisation of trade finance, focusing on the challenges faced by small and medium-sized enterprises due to the significant financial gap in the current system. It highlights the benefits of digitalisation, such as reduced errors, increased efficiency, and enhanced security.

The discussion emphasizes the need for legal harmonization and international standards, supported by the new European Union eIDAS 2.0 regulation and recent French law adopting UNCITRAL’s Model Law on Electronic Transferable Records (MLETR).

The role of a European Union Trade Services Governance

Ensure the existence of secure technological solutions accessible to the whole ecosystem, especially banks and businesses.

Foster the European TradeTech ecosystem, the solutions of which are often mature and can help achieve the goals of the reform.

Support the creation of a conducive framework for digitalisation of international trade documents at European Union level, notably when it comes to certification and management of open and interoperable ledgers.

Ensure that technical standards and requirements are clear and normative, as with PSD3 / PSR on payments, eIDAS 2 on digital identity and trust services, or e-FTI on electronic information on the transport of goods.

Technology and EU Legislation

eFTI Regulation

Digitalising the exchange of freight-related information between businesses and public authorities. It focuses on making data sharing more efficient, reducing paperwork, and improving communication in the transport and logistics sectors.

[Read more]

eIDAS 2.0 Regulation

The regulation introduces a European Digital Identity (EUDI), allowing EU citizens, residents, and businesses to have a secure and universally accepted digital identity. This can be used for identification and authentication in a range of services, such as trade, banking, healthcare, education, and more.

[Read more]

PSD3 & PSR Regulation

The third Payment Services Directive (PSD3) and the Payment Services Regulation (PSR) are new proposals from the European Commission that significantly alter the European payments market framework. These changes will affect banks, fintechs, payment service providers, and customers both legally and operationally.

[Read more]

Drive Digital Trade Innovation

105

Full Partners

Trade Associations, Logistics Providers, Shipping Lines, Banks and Insurances, Technology Innovators, Competent Authorities, etc.

59

from European Union countries

France, Belgium, Netherlands, Austria, Estonia, Finland, Italy, Latvia, Spain, Germany, Sweden, Poland, Luxembourg, Lithuania, Slovenia, Denmark, Bulgaria

46

from non-EU countries

United Kingdom, Switzerland, Montenegro, Japan, Singapore, Hong Kong, Australia, New Zealand, India, Nepal, Canada, United States of America, Cameroon, Morocco, Egypt, Kenya, Pakistan, Nigeria, Brazil, Uzbekistan, Turkey, Ukraine

Join with our consortium DigitalTrade4.EU to be part of a community shaping the future of European supply chains through innovation and collaboration.